Analysts often judge IPL auctions by headline prices, but that view misses the real strategic signal. This analysis treats the IPL 2026 auction as a decision-making exercise. The goal is not to debate who teams bought. The goal is to understand why they spent the way they did.

We start by examining how teams spent their auction money. We then assess how squads look after the auction. Final squad structure reveals the outcome of those decisions. Historically, IPL mini auctions often reflected opportunistic or reactive spending rather than clear problem-solving. The IPL 2026 auction marks a shift towards disciplined investments.

A review of auction spending and final squad composition reveals three consistent decision-making trends.

Trend 1: Role-First Allocation in Auction Spending

Hypothesis: Teams are now allocating auction capital primarily by role requirements rather than player reputation.

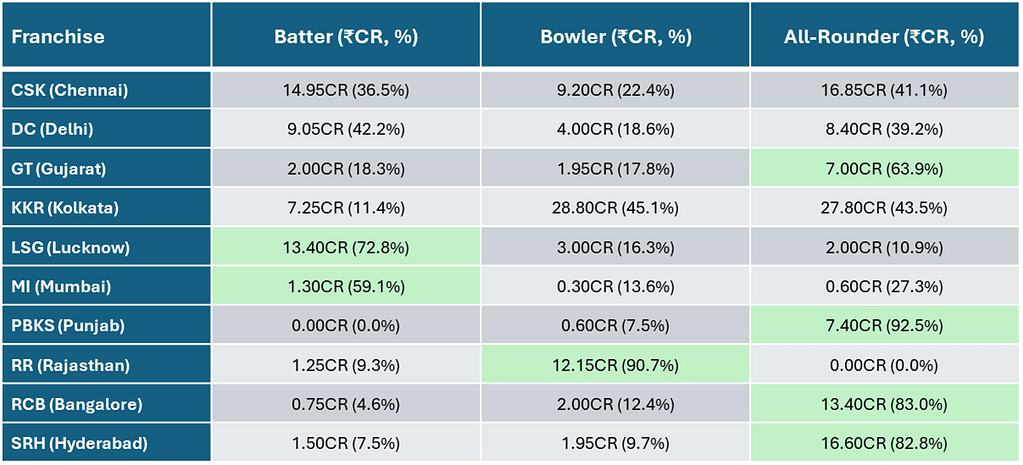

What the Auction Data Shows: Table below summarizes role-wise auction spending for each franchise, based strictly on IPL 2026 auction buys and ESPNcricinfo role classification.

Key Observation: 7 out of 10 teams have invested more than 50% of their total auction budget into a single role, indicating strong role-based concentration in spending.

The extreme concentration and deliberate omission of roles across franchises confirms a role-first, blueprint-driven auction strategy, replacing the old reputation-led bidding behaviour.

Trend 2: Auction Valuations Are Moving Away from Experience Premiums

Hypothesis: Auction valuations place reduced weight on player experience, with uncapped players attracting capital comparable to capped players.

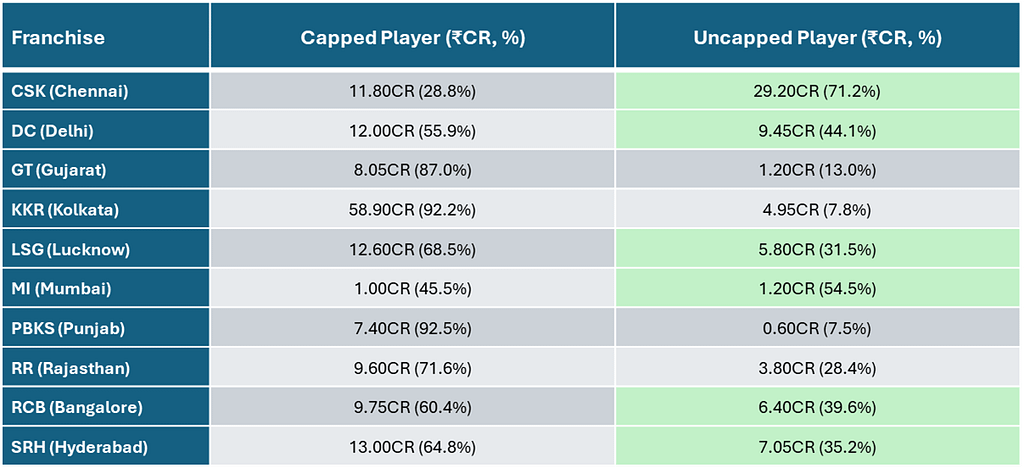

What the Auction Data Shows: Table below summarizes capped/uncapped players auction spending for each franchise, based strictly on IPL 2026 auction buys and ESPNcricinfo cap-status classification.

Key Observations: 6 out of 10 teams allocated more than 30% of their total auction spend to uncapped players, indicating that uncapped talent attracted meaningful capital across franchises. For 2 teams CSK and DC, the single largest auction investment was made in an uncapped player, showing that top-ticket spending was not restricted to experienced or internationally capped names.

The willingness of multiple franchises to deploy meaningful and in some cases dominant capital on uncapped players confirms a shift from experience-premium pricing to future-value and role-fit valuation, further weakening the traditional reputation-led auction model.

Trend 3: Batting Spend Is Front-Loaded into Retentions

Hypothesis: Most teams appear to secure batting stability before the mini auction. The mini auction is then used sparingly for batters, and mostly as a last resort. It becomes visible only when we look at final squad composition.

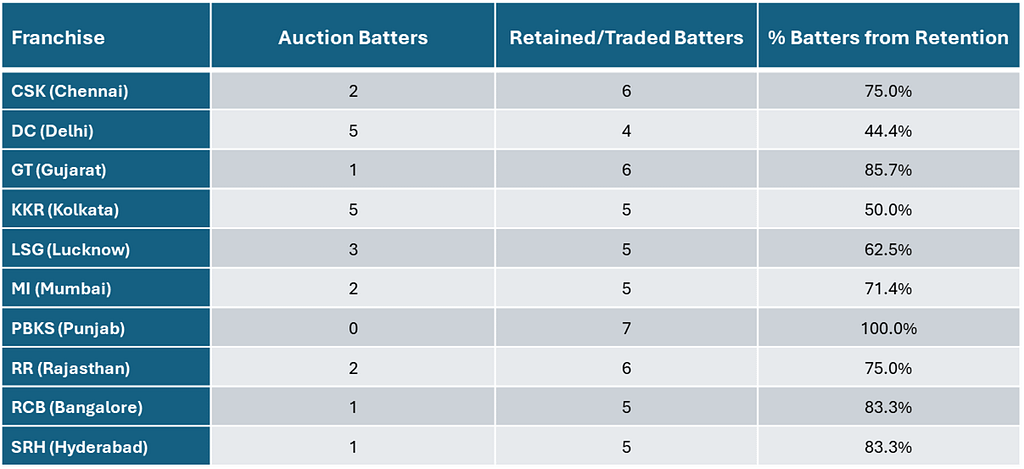

What the Squad Data Shows: Table below summarizes final squad composition by roles for all franchises, combining retained, traded, and auctioned players, based on ESPNcricinfo squad listings.

Key Observations: 8 out of 10 teams derive more than 60% of their batting from retentions/ trades. Even teams with higher mega auction churn (DC, KKR) still retain a core batting base.

The auction has ceased to be the primary marketplace for batting cores. With most franchises sourcing the bulk of their batting from retentions and trades, mini auction activity now reflects contingency filling rather than strategic batting investment.

The IPL 2026 auction reveals a clear shift in how franchises deploy capital. Auction spending is no longer evenly distributed or reputation driven. Instead, teams allocate money selectively, based on role shortages and valuation trade-offs. At the same time, final squad composition shows that not all roles are treated equally. Batting stability is largely secured before the mini auction through retentions and trades. The auction is then used to add flexibility and depth in other areas.

As experience premiums weaken, will valuation errors increase for uncapped talent under pressure? Does front-loading batting into retentions reduce risk, or does it limit adaptability over a long season? Let us know your thoughts.

You can explore our other IPL analyses and insights here.